The Biggest Tech Stock Names Aren’t the Only Ones

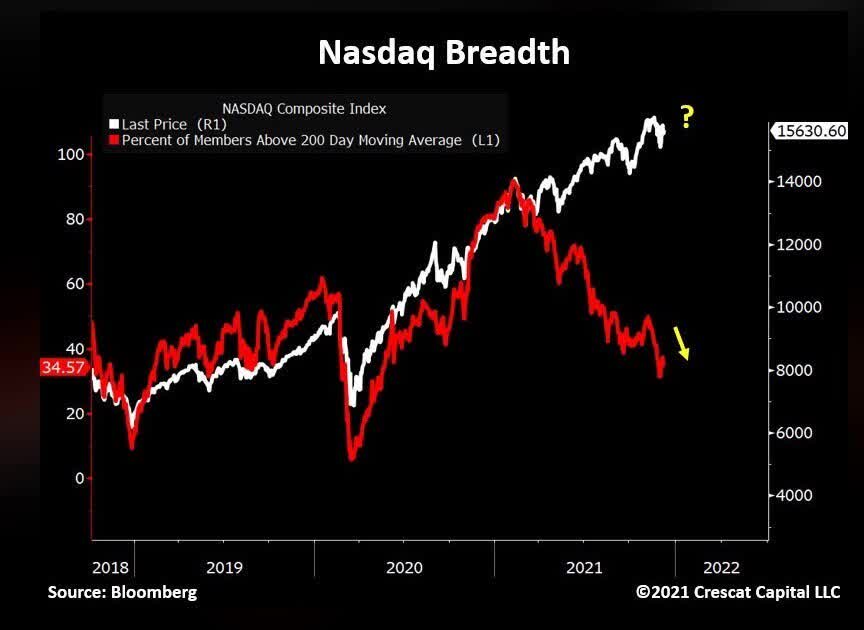

We all know the Mega-Tech names. Google (GOOG) (NASDAQ:GOOGL), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), and Facebook (FB).The Nasdaq is up 21.17% YTD. AAPL, MSFT, GOOGL, TSLA & NVDA are the top 5 return contributors YTD. Excluding the top 5 contributors, the Nasdaq is up only 5.79% this year. While these names may be the most valuable tech companies globally, I can give you the names of some tech stock sleepers to watch – YTD, each stock is up more than the S&P 500 and the Nasdaq. SA Quant has a good track record for technology stocks. From Jan. 4, 2010, to June 30, 2021, Seeking Alpha’s Very Bullish Quant Technology stocks have beaten the S&P Tech Index by 335% vs. 99%. As ranked by quant metrics and processed by a sophisticated trading algorithm, our Top Technology Stocks represent technology stocks with Very Bullish quant recommendations.

Market fear, especially with the introduction of Omicron and new variants, has reared its head. As we saw on Black Friday, uncertainty can cause investors to react in ways that can prompt a COVID Correction or Santa Clause Rally into the New Year. Notably, not all big tech names are created equal. Some of the big tech names in the industry with poor fundamentals are down over 40% in just a few weeks. Take DocuSign (DOCU) and Zoom (ZM), for example. Stocks like these had plenty of hype during the pandemic, but they lack solid fundamentals.

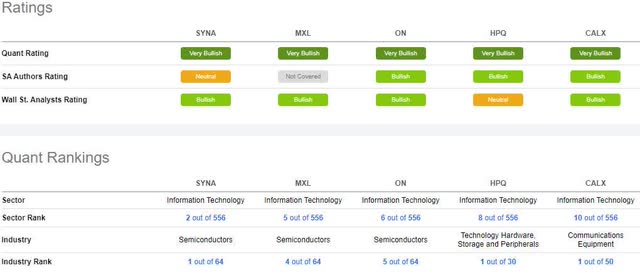

I like to focus on names that possess great fundamentals and metrics and pose excellent buying opportunities. I have a great list of Top Tech stocks going into the New Year. The technology “sleepers” like Synaptics Incorporated (SYNA), MaxLinear, Inc. (MXL), ON Semiconductor Corporation (ON), HP Inc. (HPQ), and Calix, Inc. (CALX) are the focus of this piece. Because semiconductors have been outpacing the broader market despite supply constraints, we anticipate that they will continue to outperform, which is why we’ve focused three of our five stock picks in that space. We will show you why the following five stocks will make the perfect gifts for you and your portfolio going into the new year.

SYNA, MXL, ON, HPQ, CALX Quant Ratings and Rankings

Source: Seeking Alpha Premium

Synaptics Incorporated (SYNA)

Synaptics, a leading provider of Ai, developer of human interface hardware and software, engineers the day-to-day technologies we use. From touch sensing and finger biometrics to GPS, Wi-Fi, and Bluetooth, SYNA does it all. And if that’s not enough, Synaptics announced this month its immediate acquisition of DSP Group, a leading global provider of voice processing and wireless chipsets. Adding DSP to SYNA’s portfolio is brilliant in terms of long-term vision. “DSP Group’s capabilities in SmartVoice and low power Ai align well with our long-term vision of embedding more intelligence in connected devices at the edge of a network. Further, the addition of DSP Group’s ULE wireless technology and VOIP processing solutions enhances our ability to both cross-sell and deliver differentiated solutions to our combined customer base,” said Michael Hurlston, President and CEO of Synaptics.

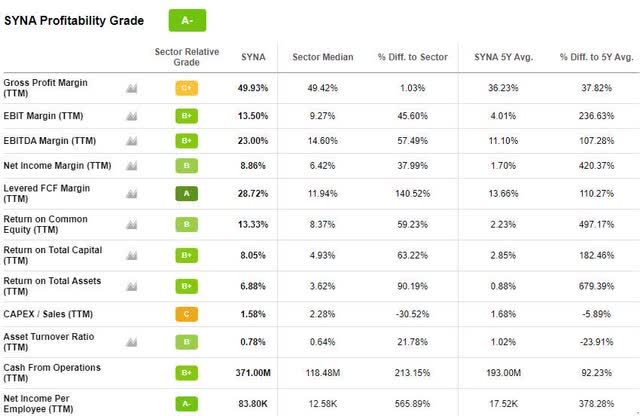

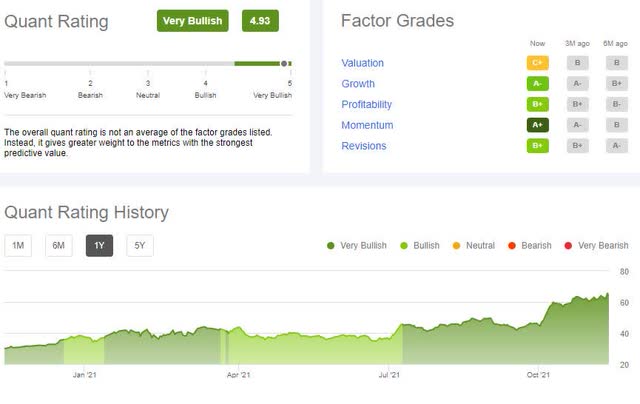

Although the overall valuation grade of D+ isn’t stellar, it does have a B- PEG ratio at 1.58X; hence, it has an attractive valuation metric when combining P/E over growth. Additionally, with a forward P/E ratio at 26x, it’s only trading at a 4% premium to the sector. Momentum is an A+ grade and continues with an upward trajectory. In addition, SYNA has an excellent Profitability Grade at A- and solid Growth. Let’s explore.

Source: Seeking Alpha Premium

Growth and Profitability

It’s a no-brainer that analysts gave 11 FY1 Up Revisions in the last 90 days and zero down revisions. With an A+ Revision grade and a Q3 Earnings Beat, SYNA’s record margins sent its shares up 7% following its announcement of top-and bottom-line results. The company sets record GAAP & Non-GAAP gross margins of 53.2% and 58.0%, respectively. EPS of $2.68 beats by $0.07; revenue of $372.70M (13.49% YoY) beats by $2.12M. “Synaptics delivered a strong start to our fiscal year 2022 with first-quarter revenue above the mid-point of our guidance, non-GAAP gross margin at the highest level in the company’s history, and non-GAAP operating margin hitting another record,” said Michael Hurlston, Synaptics’ President, and CEO during the Q3 Earnings Call.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

Let’s explore another tech company working to keep the globe connected digitally.

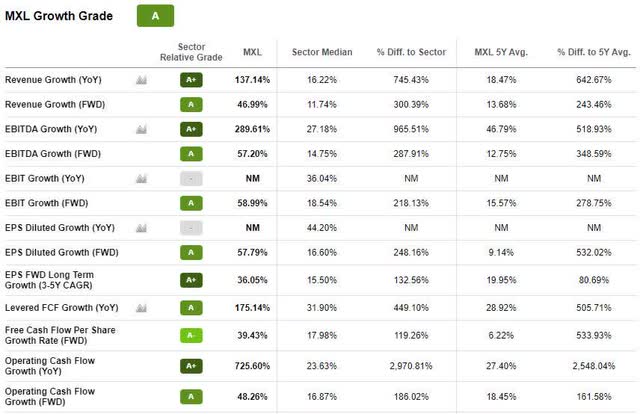

MaxLinear, Inc. (MXL)

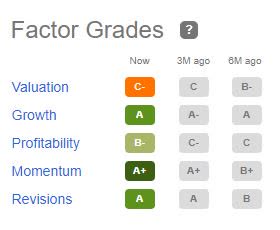

MaxLinear, Inc. is an American hardware company striving to connect people worldwide by improving the world’s communication networks via radiofrequency, analog, digital, and enhanced broadband communication applications. With strong Factor Grades for Growth, Profitability, Momentum, and Revisions, we consider MXL an excellent tech stock pick. Although the company has a C- Valuation Grade, all other factors are deep green across the board.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

Year-to-date, MXL is up more than 94%, capitalizing on the work-from-home boom. As “record growth in 2020 for broadband subscribers has driven strong demand for MaxLinear’s front-end and connectivity solutions, and the acquisition of Intel’s (INTC) Home Gateway business has gone exceptionally well,” writes Stephen Simpson, Seeking Alpha Author.

Growth and Profitability

SA contributor Stephen Simpson further writes Strong Execution At MaxLinear Is Transforming Expectations, and highlights “WiFi 6/6E is materializing as a real growth engine for the business, and content gains in on-premise equipment are likewise boosting revenue.” With a record net revenue of $229.8M, up nearly 47% YoY; GAAP gross margin 56.5%, and non-GAAP 61.3%, MXL nailed its Q3 results and is a strong buy. On the year, MXL has delivered a positive stock ascent of more than 127%, so it’s no surprise that 11 analysts have revised their estimates up within the past 90 days, bringing MXL’s Revisions Grade to a solid A. “We continue driving towards delivering sustainable and profitable growth at a faster pace than our semiconductor peer group. We are aggressively investing in key market areas with the goal of expanding our addressable markets while increasing our silicon content and improving our market share position,” Steven Litchfield, MaxLinear CFO, Q3 Earning Call.

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

ON Semiconductor Corporation (ON)

A Fortune 1000 Company, ON Semiconductor Corporation is an American supplier of semiconductors, headquartered in Phoenix, Arizona, and a leading provider of power management. ON’s mission is to create intelligent power through innovative technologies using signal management and custom devices for communications, automotive, computing, LED lighting, medical, and military use. Notably, the Seeking Alpha News Team just reported “ON Semi top picks at Citigroup, and weakness in semis should be bought.” Citigroup analyst Christopher Danely said, “With January’s earnings season on the horizon, now is a prime time for investors to buy semiconductor stocks as chip-sector shortages don’t appear to be getting better any time soon… Danely notes that business conditions for the semiconductor industry have not been this strong since 1999 and 2000, and that “many” companies are booked solid with orders through 2022.”

With a C+ Valuation Grade, ON remains attractive relative to its sector by more than 7.5%, at a forward P/E of 23.03x. Although supply constraints have posed some issues for the semiconductor industry – like many others – ON continues to advance, as exhibited by its growth.

ON Semiconductor Growth

Year-to-date, ON has increased more than 96% in stock price. There’s a good reason. After exceeding earnings estimates over the last six quarters and analysts continuing to up their earnings estimates, ON Semiconductor is a spot-ON pick! After recently reporting surprise earnings beats, 17.6% over estimates, the stock continues to climb. Earnings Revisions Grade is B+ with 26 FY1 Up Revisions in 90 Days and zero Down revisions. “I’m pleased to announce yet another quarter of record results…record quarterly revenue and record non-GAAP operating margin and earnings per share while generating free cash flow margin of 20% for the quarter. All three of our business units reported record quarterly revenue, and our targeted automotive and industrial end markets grew sequentially, achieving record revenue levels,” said Thad Trent, EVP & CFO, during the Q3 Earnings Call.

ON Quant Ratings & Factor Grades

Source: Seeking Alpha Premium

At this rate, if ON continues at the pace they are projecting, delivering on Q4 expectations, its EPS will reach a 229.4% increase over 2020.

Momentum is strong for ON Semiconductor as they have an A+ Momentum Grade rating and continue to have stellar price returns, with a price-performance return over 10 years exceeding 700%. A deeper dive into their growth grades, one sees the strong year-over-year EBITDA Growth grade of A- at 131% above the sector, and EPS FWD Long Term grade of A+, 208% above the sector. As we continue to observe the growth of this company, there’s another name in the industry that paved the way for the tech boom and is also experiencing growth.

Hewlett-Packard Company (HPQ)

Pioneer of the Silicon Valley tech boom, Hewlett-Packard Company, also known as HP, was a multinational information technology company that developed one of the first computers. Today, HPQ continues to provide computing and other devices and focuses on cloud-based solutions to help transform the way people connect and do business. The stock is also one of the few top dividend payers in the IT sector. The company’s track record for paying consistent dividends over a long period is noteworthy and demonstrates its allegiance to shareholders.

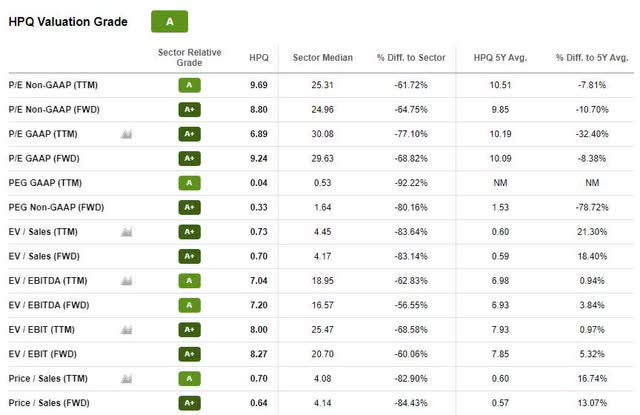

HP has an excellent reputation and valuation. The company has an ultra-low valuation relative to others in the tech sector, with Forward P/E nearly 65% below the sector at 8.8x and PEG Ratio more than 80% below sector value; the A Valuation Grade makes this stock pick very attractive. With an appealing valuation, dividend yield of 2.72%, attractive overall dividend grades, there’s not much to dislike about this bustling company.

Source: Seeking Alpha Premium

As we consider HP’s overall Factor Grades and growth potential, it’s clear that HPQ has taken advantage of the current environment. “HPQ has performed even better for investors over the last year and has been a top momentum-based Big Tech gainer during 2021. An explosion in demand for computers and printers to work/school from home during the pandemic has been the primary business demand reason for the upside spike in the stock,” said Paul Franke, SA Author. Hewlett-Packard benefited from being a solid contender and improved supply-chain solutions during the pandemic. Following HP’s Q4 Earnings Results, HP stock surged 8% to an intraday high of $38.19 after announcing that results beat expectations and outlined growing strength in sales.

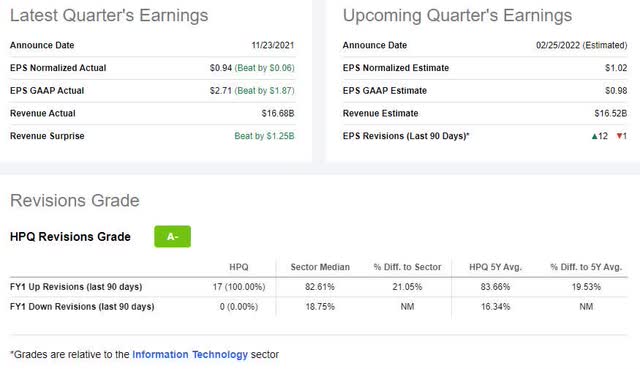

Growth and Profitability

After the announcement of Q4 Earnings Results on Nov. 23, 2021, shares of HP reached a 52-week high. EPS of $0.94 beats by $0.06; Revenue of $16.68B (9.29% YoY) beats by $1.25B. The HPQ Revisions Grade of A- is warranted, as there have been 17 FY1 UP revisions in the last 90 days and zero down.

HPQ Earnings and Revisions

Source: Seeking Alpha Premium

“Looking ahead to FY ’22, we expect to continue aggressively buying back shares at elevated levels of at least $4 billion. Our share repurchase program, combined with our recently increased annual dividend of $1 per share, has us on track to exceed our $16 billion return of capital target set in our value creation plan,” Marie Myers, CFO – HP, Q4 Earning Call.

Calix, Inc. (CALX)

Calix, Inc. is on a mission to enable its customers to simplify their business processes through the use of its cloud, software, and communication services. Rapidly growing and capitalizing on the adoption of remote work, education, and hybrid environments, CALX is in high demand. Seeking Alpha Author Justin J. Lee said it best. “I believe CALX provides a great investment opportunity for a growth-oriented investor because:

- Their customer base and revenue are growing rapidly, and I expect the trend to continue.

- Reflecting their growth in revenue, operating cash flow is rapidly improving, and the balance sheet is getting stronger.

- Their margins have been improving, although issues with the supply chain may challenge them through 2022. (Justin J. Lee)

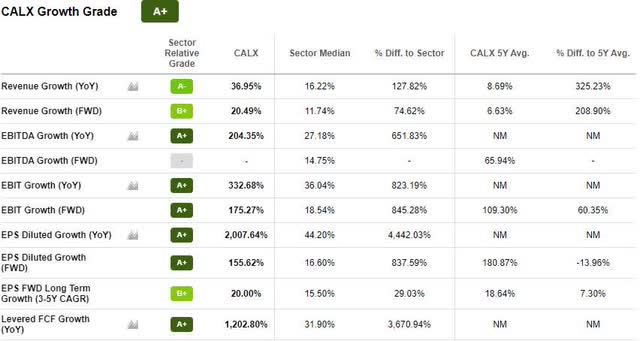

Source: Seeking Alpha Premium

Source: Seeking Alpha Premium

When you look at CALX’s growth and profitability metrics and see the A’s across the board, it’s clear why this company is on an upward trend. Over the last six months, the stock price has increased nearly 50%. Third quarter EPS of $0.35 beats by $0.07; revenue of $172.23M (14.43% YoY) beats by $4.55M. In addition, Calix has a significantly high ROE, nearly 4,500% above the sector – very impressive. It does not come as a surprise that the overall performance of CALX is why we’ve picked this tech stock as another to watch. We aim to identify stocks that have solid fundamentals and underlying metrics. While many of the stocks we’ve selected throughout this article are unique and may not trend as popularly as the mega-tech stocks investors like to discuss, the data and grades we’ve outlined speak volumes. These are the Top 5 Tech Stocks You Didn’t Know to Buy.

Conclusion: Sleeper Tech Stocks Make Money Too

Tech stocks are great buys, especially if you can identify those with fair valuations, excellent fundamentals and capitalize on their growth and momentum. In the current environment where each of these stock picks offers a good balance of growth and value, it’s a great play to diversify your portfolio and ride the digital and semiconductor wave considering sectors that are evolving and changing the way we live.

Leave a comment