Roku (NASDAQ:ROKU) has been one of the massive busts in Big Tech since the middle of 2021, with the company flipping from operating profits to losses this year. Slowing product sales and a weakening digital ad environment have hamstrung low levels of profitability (so far) in a company reaching for market share and scaling overall size. The stock quote has been crushed by 90%, falling from a peak of $476 in July 2021 to $48 last week. Basically, investors have given up on the growth story, and now believe Roku will find it difficult to ever be highly profitable as currently configured. They are wrong!

The company began selling wireless smart cameras, lights, and outlet plug-ins for your home this week. This effort should add to the appeal and stickiness of the Roku box for consumers. If multiple devices and functions in your life are tied to Roku’s operating system [OS], it will be much harder to flee to a competing streaming connection product. Plus, there are numerous ways Roku can create new advertising and subscription revenue from existing customers of its top-rated and top-used online content connection items.

The best news is $2 billion in cash and limited liabilities mean it has the resources to continue growing devices and eyeballs for years. I believe the company has plenty of time to eventually introduce and assimilate new advertising angles onto the Roku platform, arguing serious long-term investors should be accumulating a position in late 2022.

Exciting New Camera Market

Ring doorbells sold by Amazon (AMZN), Nest cameras from Alphabet/Google (GOOG) (GOOGL), and Arlo (ARLO) cameras manufactured for home and business surveillance now have serious competition from a new entrant this week. The streaming television download leader (with tens of millions of plugin sticks and small boxes networked across America), has decided to jump into wireless Smart Home device offerings, all linked to existing Roku products and the internet. For real couch potatoes, you can now flip between entertainment shows and reality cameras pointed at your life, all viewed on your television screen and smartphone.

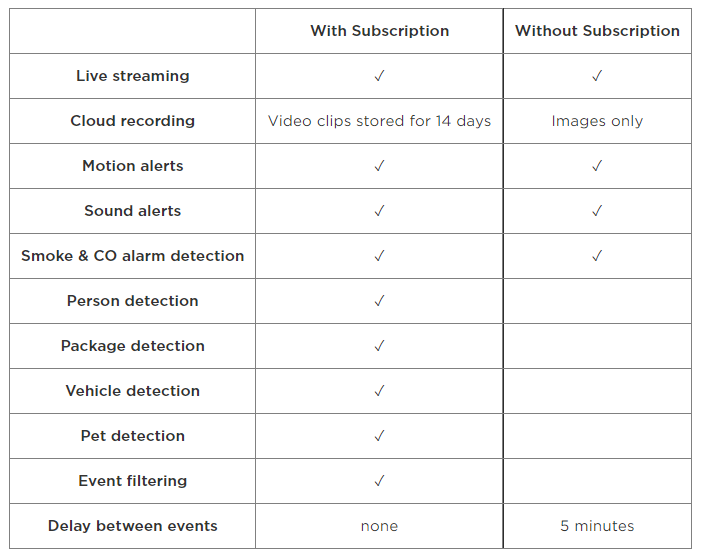

The interesting concept for this late-to-the-party, home-security camera entrant is based on the next level of convenience for existing Roku customers. Millions wanting cheap video and audio recordings of the who’s and what’s in your home are targeted. On top of sending wireless camera images/video directly to your location (inside or outside your house/apartment), the already set up Roku connection to the internet and cloud storage will be quite easy to plug and play extra cameras, lightbulbs and electrical outlets for different uses.

Launched this week (October 17th), you can find cameras at an unbeatable price as low as $27 each, exclusively sold at your local Walmart (WMT). Offsite cloud storage plans start at $30 per camera per year! This consumer-based pricing completely undercuts existing DIY security product and subscription plans available at competitors, especially if you want to bypass the expensive monitoring offerings from SimpliSafe (Hellman & Friedman LLC), ADT (ADT), Vivint Smart Home (VVNT) and others.

You can use voice commands into your Roku TV remote or your Google Assistant or Amazon Alexa to view different cameras, change lighting, or power an appliance. The goal is remotes will eventually not be necessary, as hands-free commands in the house will switch channels and lights on-and-off at home!

Roku Website – October 17th, 2022

Roku Website – October 17th, 2022

Roku Website – October 17th, 2022

Roku Website – October 17th, 2022

How to Turn Roku into a Profit Machine

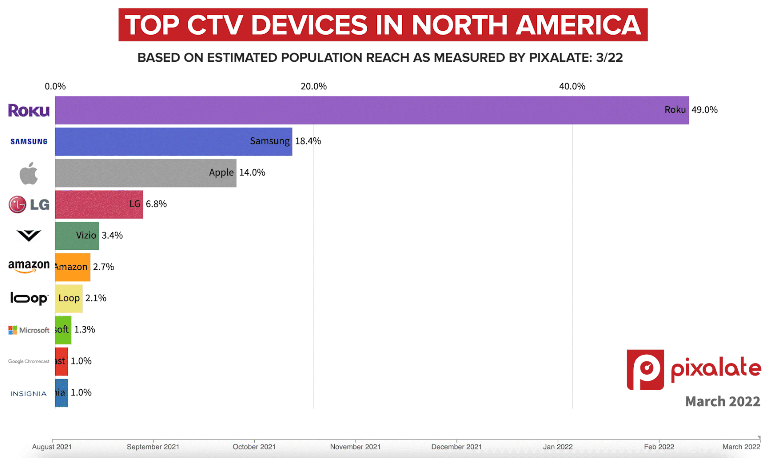

Roku aims to be the new-era “interactive” cable box, where data of all sorts finds an entry point into your home. It doesn’t mind if you prefer Disney+ or Discovery+, your favorite online startup channel for crafting, YouTube, or even a distant city’s local television station for entertainment. If you want to watch movies and shows in your living room or bedroom, there’s an excellent chance the access point is already a Roku device (49% of active internet TV connection points in North America are Roku-based).

Pixalate Blog – Q1 2022 Streaming Stats

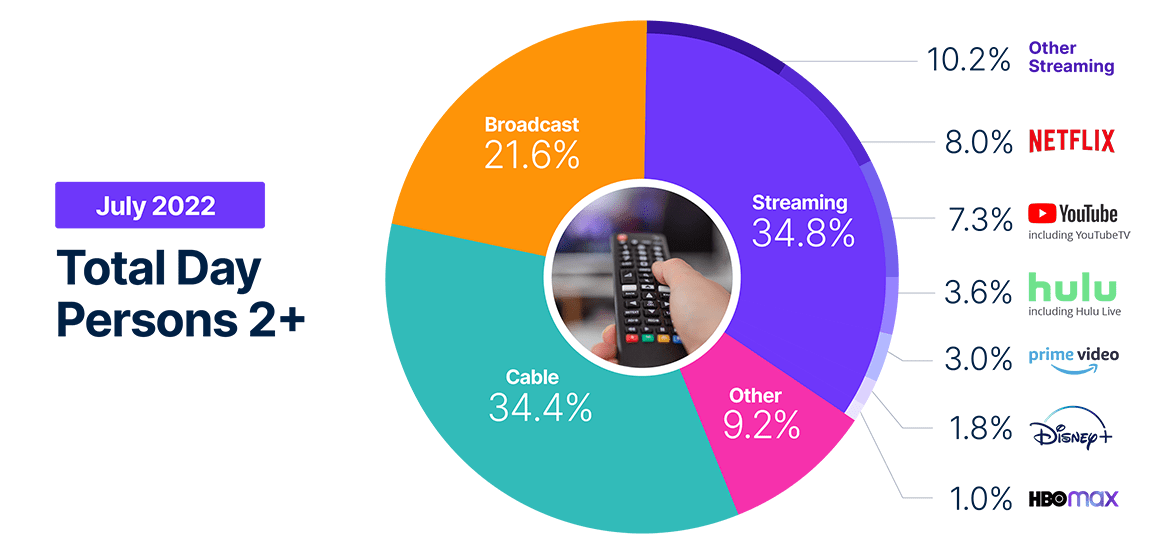

For the first time in July, streaming content surpassed cable as the main use of a television set in America. By far the largest U.S. share of streaming is sent through Roku devices.

Seeking Alpha August Article via Nielsen.com

In early 2022, Roku OS held a rough 39% market share of North American TV streaming hours and 31% of the global market, with Samsung (OTCPK:SSNLF) a distant second. Roku counted 63 million active accounts at the end of June (my household has five Roku devices tied to one account), downloading and broadcasting 20.7 billion hours of content in Q2. Average trailing 12-month revenue per user account [ARPU] was $44.10 as of June 30, 2022 as compared to $36.46 as of June 30, 2021, reflecting an increase of 21%.

How can Roku increase profitability? There are a variety of ways to add sales and immediate income with its consumer network platform. The company has been drawing ads in the background of the home screen (for starters) and pushing harder to promote its own ad-supported Roku channel through a top line placement on the main selection menu. Future licensing of the Roku OS “inside” smart TVs might include higher rates for manufacturers. The fees charged for interactive buying on shopping channels, and pay per view rates could be raised. Perhaps Roku might charge content/streaming providers a fee for placement at the top of the channel listings.

Increasing the price for new boxes and sticks to cut losses is another possibility. The key to this endeavor is not pricing devices out of the competitive market space. No doubt, adding Smart Home cameras, lights, and outlet plug-ins should add to the desirability of basic Roku boxes, dissuading users from dropping Roku operating systems for another security product with subscription cloud storage.

Radical money-raising ideas include beginning a minor subscription payment annually per user account of $5 or $10, similar to how Apple (AAPL) charges for more cloud memory storage on your iPhone. Added features or increased download speeds could also be the excuse for a separate-class subscription payment. Perhaps an extremely low “toll” for services and content streaming through its devices could be considered. For example, a charge to entertainment creators of one penny per hour of streaming would generate about $800 million in annual revenue, without dramatically altering the cost structure of individual content providers.

Roku Website – October 17th, 2022

Roku Website – October 17th, 2022

The Easy Fix

However, the simplest way to generate monster high-margin revenue without scaring away viewers (i.e. being too intrusive, adding any direct cost) or changing its business relationship (contracts for use) with streaming providers is staring everyone right in the face. There is an easy way to jump advertising revenue with one minor adjustment to the Roku experience for all involved.

My suggestion is to deliver a 15-second commercial every time you hit the home button on your Roku remote, displayed and required to view “before” pulling up the main channel selection screen. (A secondary idea is to play the commercial after you click on a channel, but before the streaming content is pulled to your device.) This moment in time may be the “most” captive eyeball and viewership period of all during your streaming experience. Because the home screen is hit when first opening access to eagerly view your favorite show or new movie release, or when channel surfing for something to watch, it would be incredibly difficult to walk away or ignore this well-placed ad.

My household probably hits the home screen button on startup and several times per day searching for something to watch on one of numerous paid streaming channels. Using a bare minimum one hit per two hours of viewing, a lowball 5-cent charge to advertisers for prime placement in front of Roku viewers would add up to $2 billion annually, increasing total company revenue by better than 50%! And, this sum would almost entirely morph into extra operating profit, turning $500 million in worst-case scenario losses (the current Wall Street 2022 estimate) into $1.5 billion in operating income, for at least $1 billion in annual after-tax, net profits.

Pretty much overnight, Roku would morph into the must-engage ad media platform for the greatest bang on your marketing buck. Every major ad firm and large company would have to pony up, or be left behind targeting ads on inferior Google or Meta Platforms (META) social media sites. For massive scale and viewership traffic reaching tens of millions daily, the initial home-button commercial on Roku devices could quickly become the coveted SuperBowl-like advertisement play in our everyday future.

Investors would value Roku stock with 20% to 30% after-tax margins as a premium media play, perhaps with even greater long-term worth than Netflix or Disney shares. Forecasting an immediate double in the share price would be just the beginning for Roku owners. Putting a minimum 20x P/E on $1 billion in earnings gets you to $150 a share quickly. And, if I am “understating” home-button ad pricing or the sheer number of TV draws on this one-of-a-kind marketing slot, shareholder earnings of $2 or $3 billion on scaling numbers of Roku device owners is possible a few years out. Putting a 20x P/E multiple on this result gets you closer to all-time highs over $400 per share. Such would be a home-run investment return for Roku buyers around $52 today.

Cheapest Roku Valuation Ever

Huge investment returns would not be possible, unless today’s ultra-bearish sentiment in Roku was reality. To get multibaggers for performance gains, you want to find a stock completely unloved with a low valuation just before amazing company income growth appears. This may be the best explanation of Roku’s investment potential today.

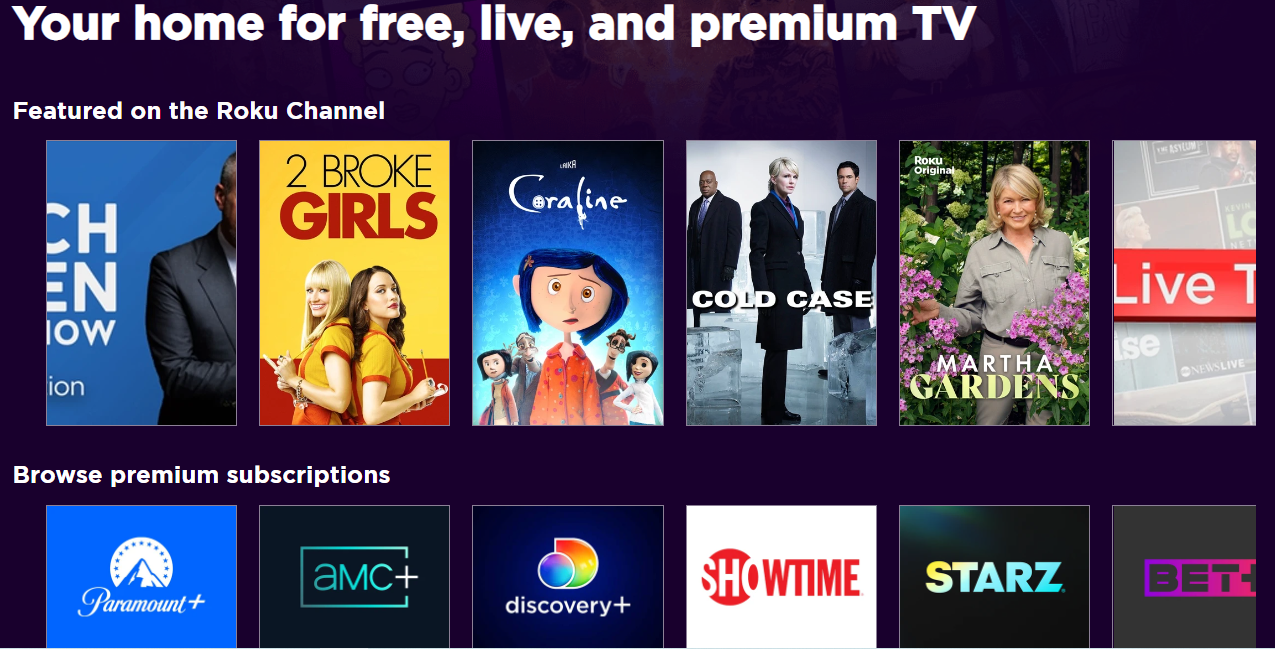

Below is a graph of the sharp reversal (but likely a short-term phenomenon) in EBITDA margins (earnings before interest, taxes, depreciation and amortization) for Roku, appearing right after a mania peak in Big Tech during the middle of 2021. Essentially, a disastrous collapse in price during the Big Tech bust has been exaggerated by a downturn in profits at Roku. Nobody wants to own Roku presently and few can see the light at the end of the tunnel for operating losses.

YCharts – Roku, Stock Price vs. EBITDA Margins, Since 2017

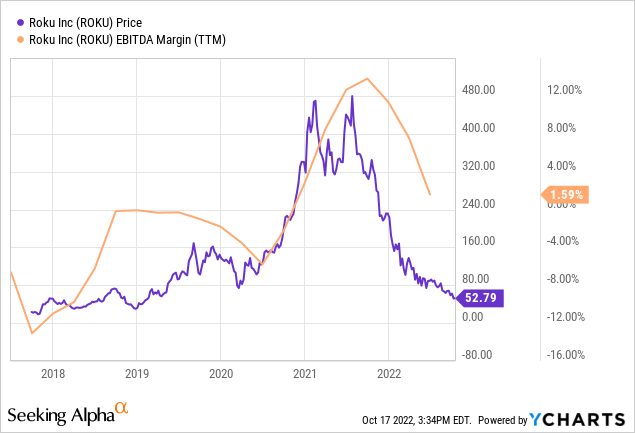

Pictured below, the enterprise value [EV] to revenue ratio highlights the tremendous buy opportunity in Roku that has opened in October 2022. From early 2021, this ratio has fallen 95% from 33x to 1.6x today.

YCharts – Roku, EV to Revenues, Since 2017

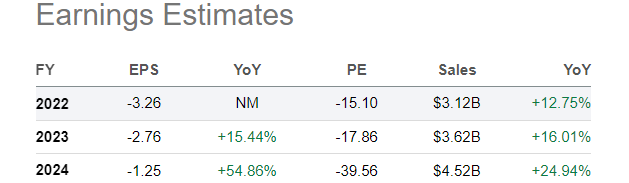

When you review currently bearish forecasts from Wall Street analysts, you can easily lose faith in Roku. I completely understand the pain, frustration, and disgust investors have for Roku after losing mountains of capital owning shares the past 18 months.

Seeking Alpha – Roku, Analyst Estimates, 2022-24

One piece of good news relatively few understand is Roku has not expended much shareholder capital and does not need outside financing to keep growing. Non-cash stock-based compensation (counted as paid-in capital) is offsetting reported paper operating losses. The net result is very little cash burn is part of the 2022 loss setup. Per share book values are falling slightly, but the company has plenty of liquidity to support growth for many years. Assuming estimated losses become reality into 2025, I do not foresee outsized investment losses will necessarily result for Roku owners buying/holding at $52. It’s possible the worst-case operating scenario is already priced into the quote (or soon will be).

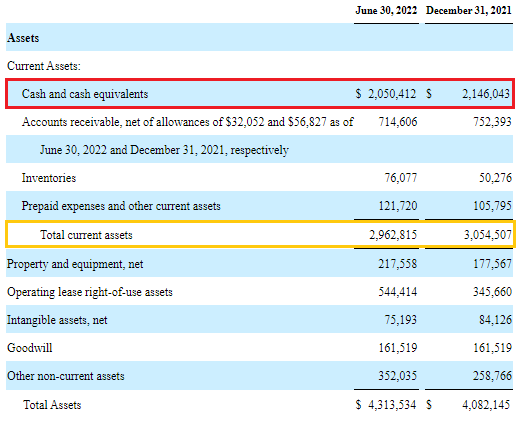

Fortress Balance Sheet

What I like best about the current investment setup is the company held $2 billion in cash and $2.9 billion in total current assets vs. $1.5 billion in total liabilities at the end of June (pictured below). With negligible cash burn on high non-cash levels of stock compensation, the underlying business is not hurting at all in late 2022. Growth initiatives like the Smart Home camera project can be fully funded for years. I have boxed the “Additional paid-in capital” and flat “Total stockholders’ equity” lines on the Q2 balance sheet below, which highlight stable business worth despite reported income losses for a spell.

Seeking Alpha, Roku Q2 Assets

Seeking Alpha – Roku Q2 Liabilities and Stockholders’ Equity

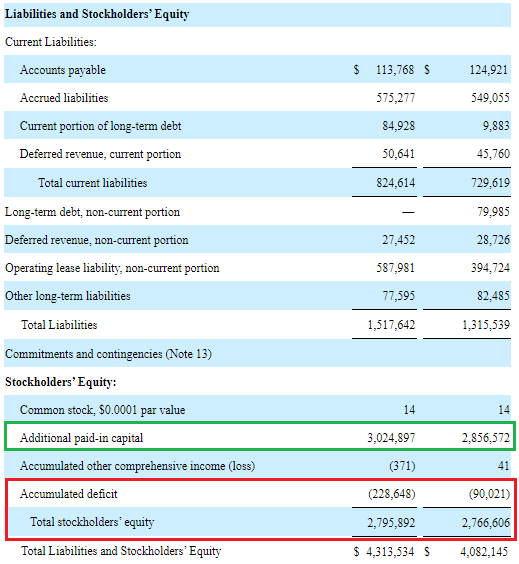

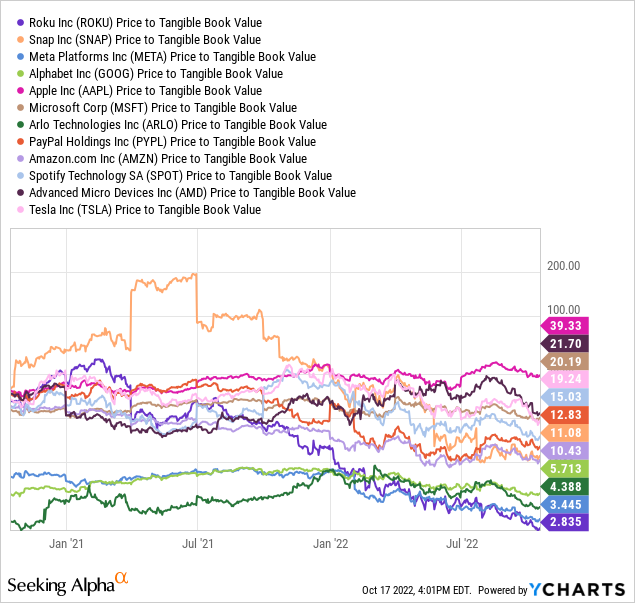

How strong is the balance sheet vs. large U.S. entertainment and technology companies? I rate the levels of cash, tangible book value, and minor liabilities due as “A” rated. Below is a graph comparing price to tangible book value vs. a select group of peers. If your favorite entertainment or tech business is not included on this list, it likely does not have a “tangible” book value. The vast majority of related firms have enormous goodwill and intangible assets, which push physical-world book values into deep negative territory vs. total liabilities.

YCharts – Major Tech/Entertainment Companies, Price to Tangible Book Value, Since November 2020

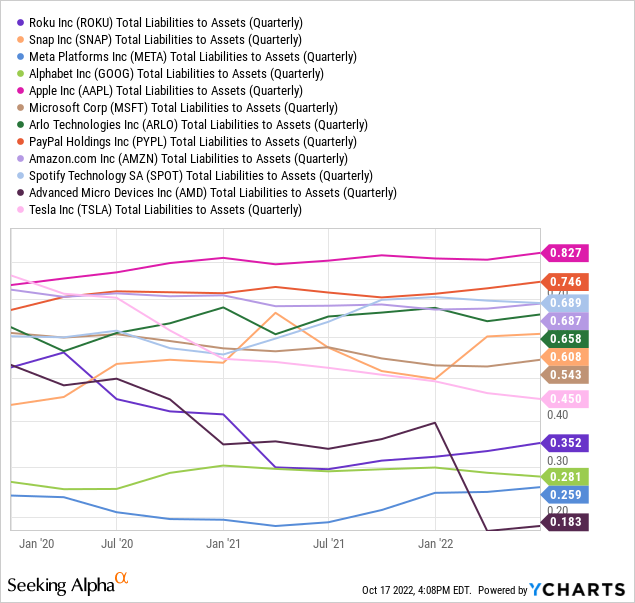

From this group we can also compare total liabilities to assets (including intangible assets). Again, Roku scores very well for an investment choice with underlying asset value and low liabilities. It is in the same league as cash-heavy Alphabet/Google, Meta Platforms, and Advanced Micro Devices (AMD).

YCharts – Major Tech/Entertainment Companies, Total Liabilities to Assets, Since November 2019

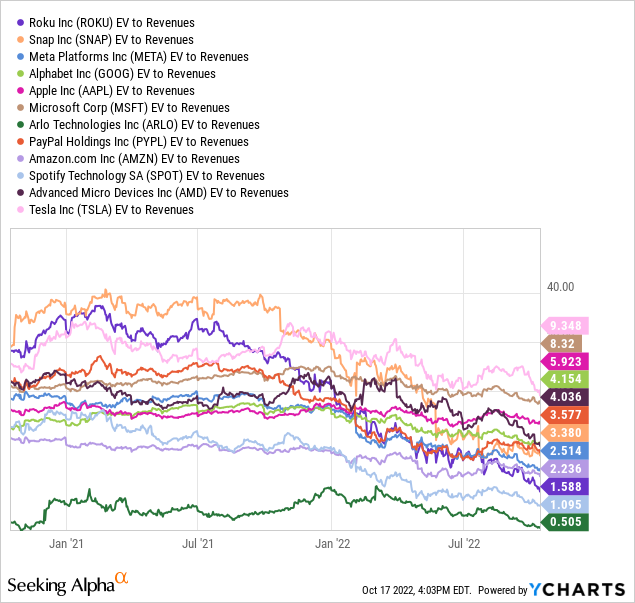

Lastly, EV to revenue is an interesting data point to review, especially if sales can rise markedly as Roku increases advertising placement over its network platform.

YCharts – Major Tech/Entertainment Companies EV to Trailing Revenues, Since November 2020

All management has to do is introduce the home-button ad (with a few lines of computer code and an expanded sales team), and snap your fingers, Roku is one of the cheapest, high-growth names any investor in the world can own (with skyrocketing income stats appearing literally overnight).

Trading Momentum Improvement

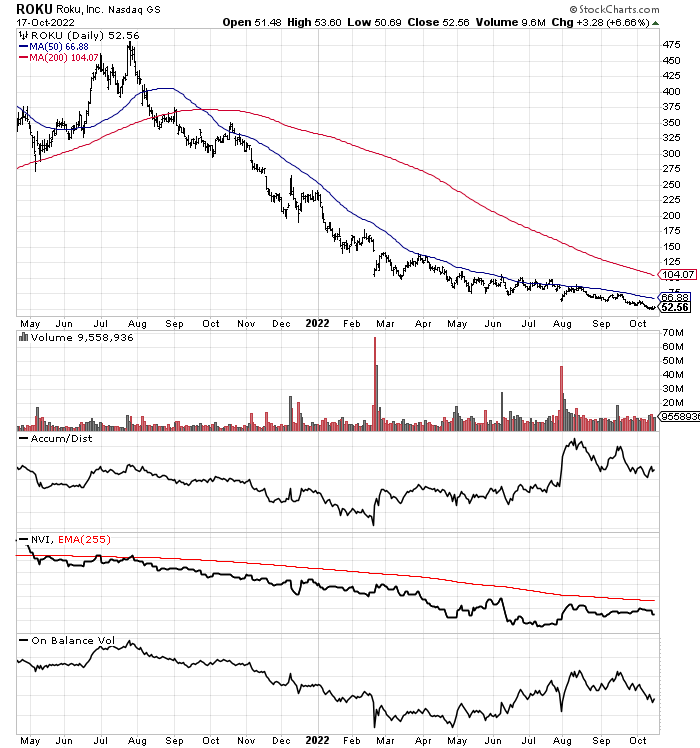

But there’s more to the bullish argument. I find it fascinating many momentum indicators of stock trading action have actually bottomed are now rising! Below is an ugly 18-month price/volume chart of daily changes with some of the momentum constructs I like to track.

As you can plainly see, the Accumulation/Distribution Line bottomed in February, On Balance Volume reversed higher in April, and the Negative Volume Index has trended in a positive direction since July. Typically, when price is falling fast, one or more of these three indicators are in collapse mode from volume selling. The “tell” from this chart is selling interest has been more of an emotional arbitrage-related affair (buyer’s strike) mirroring the Big Tech bust of late. So, if a serious reason to buy appears (exhibit #1 new advertising placement is rolled out), price could rebound rather swiftly.

StockCharts.com – Roku, 18 Months of Daily Changes

Another Priceline Pattern?

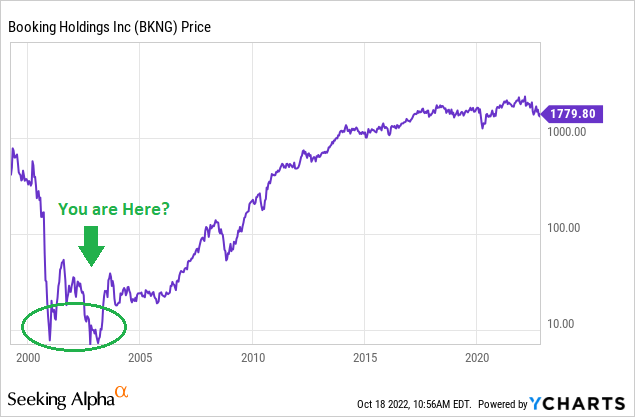

For a parallel investment comparison, I keep thinking Roku could be the next Priceline.com, now Booking Holdings (BKNG). After the dot.com bust of the early 2000s, Priceline fell to a crazy low valuation with tons of short sellers holding back price at its bottom under $10 per share in 2003. Investors could only process the large multi-year decline, and were not looking forward to people booking vacations at home on their own, cutting out travel agent fees. 20 years later Bookings now trades for $1,780 per share (under its $2,700 peak in early 2022). Believe it or not had you bought at $8 a share and held through today, you would be sitting on an investment gain of 22,000%. Buying 100 shares for $800 in 2003 would now be worth $178,000! Am I saying Roku will generate a similar return over the next 20 years? Probably not, but intelligent management of its leading TV streaming position could create a 10x or 20x investment gain over the next decade.

YCharts – Booking Holdings with Author Reference Point, Since 1999

Final Thoughts

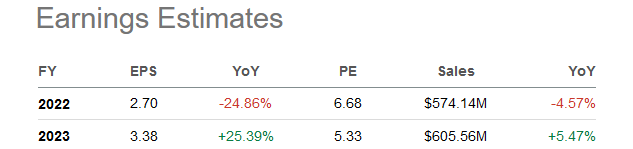

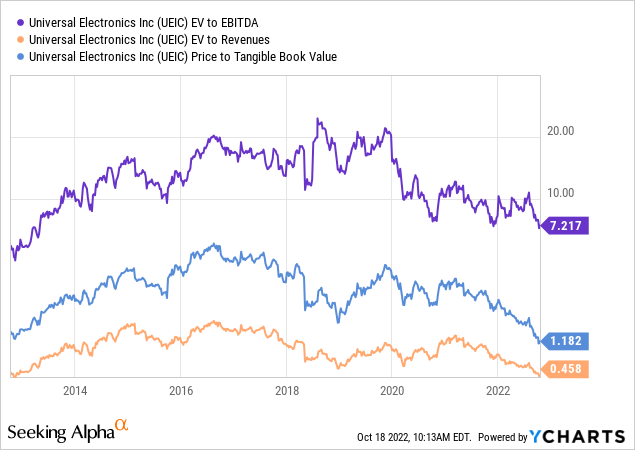

Another strategic, accretive, and immediate move management should make is to acquire Universal Electronics (UEIC), the primary international patent holder of basic remote-control technologies, sporting a minor $220 million in equity value currently. The two have been embroiled in patent lawsuits for several years. With a super-cheap valuation and upfront buyout cost today, a takeover bid makes perfect sense, funded either with cash from Roku’s war chest or the issuance of stock. Universal itself also sells very close to its liquid, net tangible book value reading, with working capital representing about 50% of the current $18 stock quote and plant & equipment the other half. Below are forward estimates for UEIC, and a graph of 10-year low EV to EBITDA and revenue calculations, alongside price trading just above tangible book value.

Seeking Alpha – Universal Electronics, Consensus Analyst Estimates, 2022-23

YCharts – Universal Electronics, Valuation Multiples, 10 Years

Owning the base patents for remote controls globally would allow the company a bigger say on the evolution of interactive home entertainment and security. In a nutshell, Roku could put huge roadblocks up for future competition looking to erode its market-leading position, by asking for extreme royalty rates.

What’s the downside risk for Roku investors? That’s a great question. As long as growth continues in underlying business metrics, I think it’s hard to project Roku selling under 2x its liquid tangible book value (using my 36 years of trading experience in a variety of bear markets), which works out to $35 per share. My rock-bottom price to aggressively buy is around $40. To me, this is the area where future EPS growth expectations are discounted to almost zero.

I have been contemplating the purchase of Roku shares since reaching $100 in May, but have refrained for a better valuation and lower price, as the economy slips into recession. In prolonged bear markets on Wall Street, companies lacking income generation can fall to incredibly low valuation levels on net assets and sales.

I finally bought a starter position in the low-$50s over the past week. My current buy plan is to purchase additional shares closer to $40 or after Q3 earnings are released November 2nd. Weaker than expected operating numbers and guidance could still push the quote lower for another month or two. Plus, tax-loss selling may hold price in check until late December.

In my research and contemplating the easy ways Roku can jump ad sales and company profits, I would categorize Roku as the “sleeping giant” of streaming. It controls the gateway to roughly half of North America’s connected TV experience. When management wakes up to all the different avenues available to create owner value, I fully expect Roku to trade above $100 again soon, perhaps by the summer of 2023.

In the end, Roku would also make an excellent acquisition target for a bigger fish. Its current $7 billion market cap is easily digestible by another Big Tech name like Microsoft (MSFT), Amazon, Apple or Google wanting kingly control over the streaming universe. I suspect the buyout rumors that have been rampant since spring will continue.

Leave a comment