Building an investment portfolio is like planning a vacation: You want to find the right balance between the places you know and some exciting surprises. And when it comes to an investing destination with plenty of variety, the tech sector has it all: e-commerce titans, AI-powered juggernauts, and software behemoths. All in all, there’s more than enough diversity in this sector to keep things interesting.

So, let’s say you were creating a hypothetical $50,000 portfolio comprised solely of tech stocks. Here’s how I would balance it.

Amazon

To start, I’m allocating $25,000 (50%) of my portfolio to Amazon (NASDAQ: AMZN). That’s because with its numerous business segments that stretch across e-commerce, digital advertising, and cloud computing, Amazon provides growth and diversification.

And the company is as strong as ever. CEO Andy Jassy is putting his stamp on the company after taking over for Jeff Bezos in July 2021. Jassy has trimmed head count across the company and delayed or canceled some costly capital expenditures.

As a result, Amazon’s profitability has bounced back. Net income in its most recent quarter (ending on June 30) soared to $6.8 billion. Better yet, revenue growth is accelerating despite the cost-cutting, with $538 billion in revenue over the last 12 months and quarterly revenue growth hitting 11%.

The current price-to-sales (P/S) ratio of 2.4 is still far below its long-term average of 3.2, meaning that investors can snap up shares of this tech leader at a reasonable price.

Adobe

Next, I’m allocating $5,000 (10%) of my hypothetical portfolio to Adobe (NASDAQ: ADBE). There are many reasons to like Adobe stock, but let’s focus on two: its business model and its products.

First, Adobe operates a subscription model that generates billions of dollars in annual recurring revenue. For example, in its most recent quarter (ending on Aug. 31), Adobe’s digital experience segment had $1.2 billion in revenue. About 90% of that revenue, $1.1 billion, came in the form of subscription fees. That’s great news for investors, as recurring revenue is a more reliable way to generate sales.

Second, Adobe’s products set the company apart, giving it a massive competitive advantage. It has sought-after applications for use in multiple industries, such as design, marketing, education, entertainment, and healthcare.

While Adobe has never been a cheap stock (and it still isn’t), shares do trade below their long-term average. Today, it has a P/S ratio of 12.3, below its three-year average of 14.5.

Microsoft

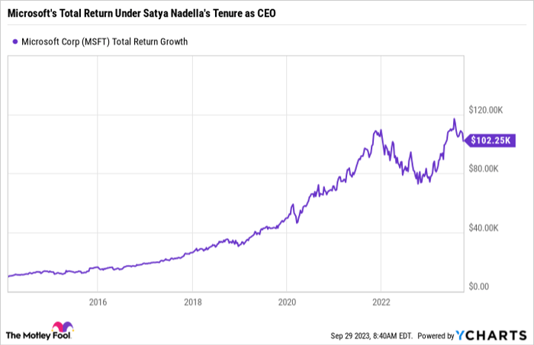

Lastly, I’m allocating $20,000 (40%) of my hypothetical portfolio to Microsoft (NASDAQ: MSFT). To round out my portfolio, I want a stock that has consistently beaten the market thanks to its stellar management, and that’s Microsoft.

MSFT total return level data by YCharts.

Since current CEO Satya Nadella took the helm in 2014, Microsoft’s stock has skyrocketed an astounding 922%. That amounts to a compound annual growth rate (CAGR) of 26%. For comparison, the S&P 500 has generated a CAGR of about 11% over that same period. Looking ahead, Wall Street expects Microsoft to grow revenue 13% next year, with earnings per share expected to jump 15%.

In addition to its excellent track record and rosy forecasts for the next 18 months, management has an ambitious long-term plan. Documents from an ongoing court case showed that it wants to increase annual revenue to $500 billion by 2030. That would mean more than doubling its current revenue, and if Microsoft can pull it off, investors should expect the stock to soar.

Leave a comment