As the pound extends the deepest slump among developed-world currencies, a host of market indicators are converging to suggest the worst is yet to come.

Sterling slid more than 3% in the past month, with losses accelerating this week as data showed the U.K. economy may be headed for the deepest recession in three centuries amid the coronavirus crisis. Technical charts and option pricing point to more pain for the currency as money-market bets rise that the Bank of England will cut interest rates below zero next year to revive growth.

Governor Andrew Bailey said Wednesday it’s “pretty clear” investors expect more quantitative easing from the BOE, and that monetary loosening is helping the government fund the cost of economic aid amid the pandemic. Deputy Governor Ben Broadbent even hinted at the possibility of negative rates, while Federal Reserve Chairman Jerome Powell pushed back against the notion.

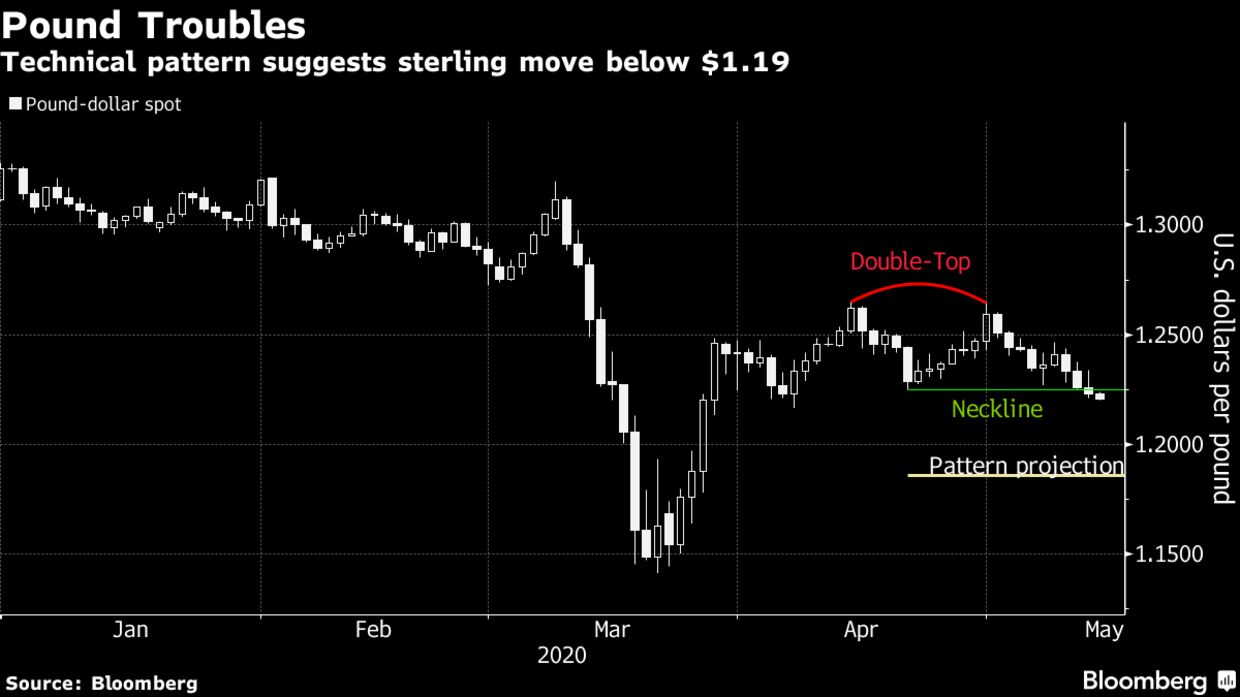

A chart formation known as the double top is signaling more risk for the pound-dollar pair. Sterling has already breached the so-called neckline of the pattern on a closing basis, suggesting it could extend declines by another 3% to test support levels around $1.1850. The British currency dropped as much as 0.4% Thursday to $1.2181, the lowest level since April 7. Its 3.3% loss in the past one month is the biggest among advanced economies.

U.K. money markets are now pricing in negative rates for early 2021, in a similar move to U.S. fed fund futures — also pointing to sub-zero rates around the same time. Such rate expectations may weigh harder on sterling’s prospects, with recent comments from policy makers suggesting the BOE could move faster than the Fed to ease policy.

The brewing pessimism offers little surprise to option traders. Risk reversals, a barometer of market positioning and sentiment, have been steadily trading at levels indicating a deeply bearish outlook for the U.K. currency. There are also lingering signs that Brexit trade risks aren’t priced in yet, leaving the pound facing the strongest set of headwinds among its peers.

Leave a comment