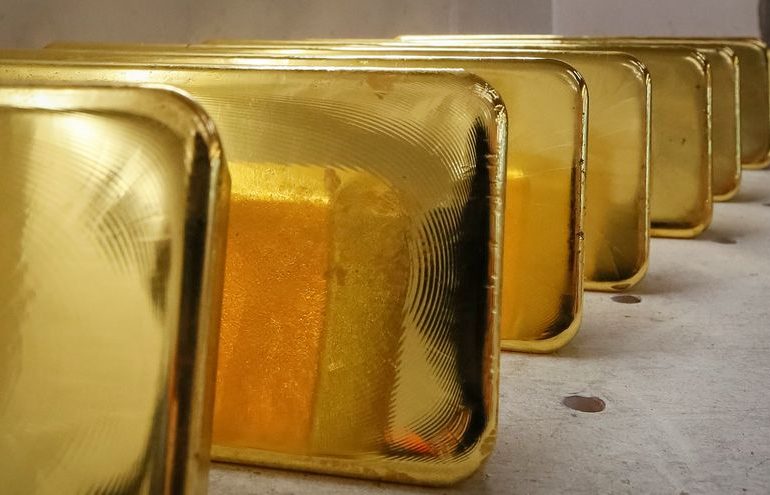

Gold was up on Monday morning in Asia but remained little changed. Investors continue bracing for the U.S. Federal Reserve’s latest policy decision, while concerns over inflation and geopolitical tensions in Eastern Europe burnish the yellow metal’s safe-haven appeal.

Gold futures were up 0.28% to $1,836.90 by 11:12 PM ET (4:12 AM GMT). Benchmark U.S. 10-year Treasury yields crept up toward 1.77% on Monday after their fall during the previous week.

The Fed will hand down its policy decision on Wednesday. It is widely expected to tighten monetary policy at a faster pace than expected to curb the continuously high inflation, now viewed as the biggest threat to the U.S. economy in 2022 according to a Reuters poll.

The Bank of Canada will also hand down its policy decision on the same day as its U.S. counterpart.

Tensions between the U.S. and Russia over Ukraine continue, with the U.S. on Sunday ordering the departure of eligible family members of staff from its embassy in Ukraine. It also urged all its citizens to leave the country as the risk of armed conflict increased.

Meanwhile, British Deputy Prime Minister Dominic Raab warned on Sunday that Russia faces severe economic sanctions if it installs a puppet regime in Ukraine. Raab was responding to reports that Russia aims to place a pro-Russian leader in power in Ukraine.

Meanwhile, gold was sold at a discount in India during the previous week, with rising domestic prices impacting demand and jewelers looked ahead to the country’s annual Union Budget 2022-23, which will be presented by Finance minister Nirmala Sitharaman on Feb. In other key Asian centers, the upcoming Lunar New Year holiday is driving demand.

In other precious metals, silver was flat at $24.23 an ounce and palladium was down 0.3%, while platinum edged up 0.2%.

Leave a comment