TikTok (BDNCE) has been put into an impossible situation. It either gets bought or banned, and neither scenario gives it high hopes it will continue on its popularity path. Meanwhile, this news couldn’t be more bullish for Facebook (FB), as the situation weakens a competitor, or, in an equally likely scenario, also relieves Facebook of the perception that it’s a monopoly – whatever that means in the multi-medium $563 billion advertising market (as of 2019).

(Source: Fortune.com)

An acquisition of TikTok by Microsoft (MSFT) would ultimately be a turning point for TikTok. The vibe from the tech scene is Microsoft is where acquisitions go to die, or at least be disfigured. Not to mention, between 70 and 90 percent of acquisitions fail, and Microsoft is no exception to that statistic.

A Slow Death

Look at the initial jump away from GitHub in the hours and days following Microsoft’s acquisition announcement. Yes, some repos and projects started returning in the weeks and months following, but that knee-jerk reaction wasn’t for naught – it’s a reputation Microsoft carries. It’s still very much alive, as popular TikTok influencers are thinking it could be best to do more Snapchatting (SNAP) on the heels of this M&A news cycle.

Of course, Microsoft has let GitHub be and hasn’t touched much, if anything, regarding the platform or its mission; it has allowed it to do its own thing. As someone who uses the platform on a daily working basis, I’m not troubled by the acquisition. But Microsoft acquiring TikTok cannot be left to its own devices. The entire reason it’s looking to buy the social media platform is to change not only ownership, but to change data practices and reconfigure the app to be “more secure” and American-based:

Microsoft has pledged to add more security and protections to the app, ensuring that all private data of Americans be transferred to the U.S. and deleted from servers outside the country.

I think of Skype and the terrible program it is today (after using it a lot when it was at the height of popularity), and how Microsoft didn’t keep up with stability and threw away the concept of scalability. Instead, the company created Teams and now has Skype staged to an end-of-life burial in 2021. $8.5 billion may have acquired some technology used in Teams, but it turned a lot of users off in the years leading up to this software sun-setting. That is to say, Microsoft has a history of touching things (or not) and not doing so great.

On the other hand, it has had a more recent history of being more open-source friendly – going back to the GitHub example – and building brands such as Teams and Office 365 to revenue pillars in the company. Microsoft can do things right. But it’s not the same as acquiring a wildly popular social media app at arguably the height of that popularity and gutting the data aspect of it to stiff-arm China. That reeks of risk.

What’s this have to do with Facebook, Joe?

A lot. The risk I speak of is Microsoft completing this TikTok acquisition, transforming it, and allowing it to grow still. This risk means a Facebook competitor may be seeing the beginning of its end. This is truly an execution risk for Microsoft. TikTok won’t be as popular a year from now as it is today, should this acquisition happen.

Oh, wait. It won’t be as popular in a non-acquisition scenario either, as it likely gets banned in the US without one. TikTok has been put in an impossible situation.

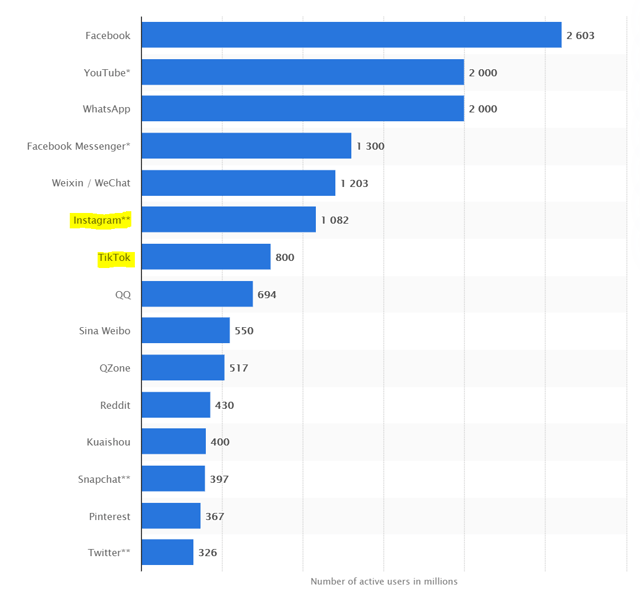

I’m not saying the execution risk materializes for certain, but again, I stress the risk aspect of this process. It will not be simple engineering-wise, it will take time, and it will have political repercussions with the good standing Microsoft has with China. Facebook, conversely, has little China risk, since, well, it has always been banned there! Add to this the fact Snap has begun adding music for users to use in Snaps, while Facebook has launched Reels, the direct competitor to TikTok, on Instagram, which has more than 280 million active users than its competitor.

(Source: Statista)

Politics, Politics, Politics!

But there’s a step further. Facebook can get itself out of political trouble by no doing of its own. Consider the on-again, off-again beatdown of Facebook, Google, Apple (AAPL), and Amazon (AMZN) with regard to “monopoly” talk among US legislators… oh, and President Trump, too. There’s some serious risk to consider with regulations or legislation getting passed to either break-up or regulate the industry as a whole.

Enter Microsoft. It breaks up the supposed monopoly of Facebook and Google (notice, five of the top six social media apps are owned by those two). Microsoft now enters with the seventh most popular app. Hard to say there’s a monopoly between just two and, more precisely, just one.

This is why Facebook stock jumped on Thursday when news hit the wire Microsoft is rumored to be looking at not just acquiring US-based operations of TikTok but all of TikTok. The political risk for Facebook would be alleviated.

Let me take it yet another step further and drive home how Facebook wins in any scenario. TikTok, a serious competitor according to Facebook bears, either gets banned in the US, reducing growth and popularity, gets acquired only in part by Microsoft, causing difficulty in separation of the back-end and other business departments, or gets acquired in whole, leaving the monopoly talk at the front door with the transition risk squarely on Microsoft’s shoulders.

Facebook can potentially see both its largest overhangs hit the bear talking points memo wiped out in one single transaction: its competitor gets acquired in full and dragged across Microsoft’s shop floor, while also alleviating legislative hurdles, as it’s hard to argue adding another US competitor doesn’t cut against the “break-up” talk.

TikTok is dead. Facebook wins.

Don’t worry, Facebook won’t let this go to waste. Its outperformance of the Street’s expectations as well as Google’s advertising business has come at just the right time. Facebook is in the best position it has been in since before Cambridge Analytica hit the front pages.

Leave a comment