Staying at home and practicing social distancing allows many crypto-curious to sit back and learn more about cryptocurrency. According to Glassnode, the number of addresses holding at least 0.01 BTC rose to a new high of 8,439,298, despite the fact the Bitcoin continues to trade at the narrow range of $9,000-$9,300.

When you enter the crypto world, you would probably hear stories of overnight success and being introduced to either spot trading or margin trading, two of the most popular tools in the crypto market. However, although they are mature and have the potential to generate a large sum of money, you should remember that high return always comes with high risk.

Spot trading generates profits solely depending on the appreciation of your coins. With Bitcoin being trapped and a bull run far, far away, you are not likely to earn money anytime soon.

So, how about margin trading? Even in the downtrend market, you could still earn profits by shorting Bitcoin. Furthermore, the leverage provided by crypto exchanges enables you to magnify your profits. This is extremely useful when the market enters a low volatility stage. But beware, while profits could be magnified by leverage, so could losses. So if you are new to the market, you might want to start small instead of following the saying of “go big or go home.”

Interest-bearing Wallet: a Gateway for New Crypto Users

Interest-bearing Wallet has gained popularity in recent years with its high security. When traders are not trading, they can store the BTC in the wallet and earn some passive income. Usually, the exchange will lend the deposits to other traders, and the borrowers will have to pay interests. On some platforms, the lent deposits are “locked up”, so you will need to wait for the borrowers to close their positions if you want to take back your deposits. The interest rates vary from platform to platform. For Binance, the estimated annual yield of the BTC deposit is about 0.7%.

Bexplus BTC Wallet – a Trustworthy Wallet with Up to 30% Interest

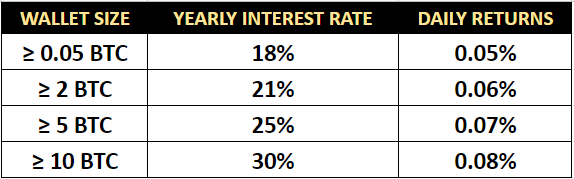

Bexplus, a leading crypto-trading platform offering 100x perpetual contracts on BTC, ETH, LTC, EOS, and XRP, recently launched its innovative interest-bearing wallet with up to 30% annualized interests. Without a doubt, this is the highest rate in the industry.

The interest is calculated daily and the revenue of the deposit will be settled monthly. The monthly interest is calculated as (S*I/365*30)=MI. S represents the sum of the deposit, I stands for interest, and MI is the monthly interest.

If you deposit 10 BTC in your wallet, the monthly interest you would receive is (10*30%/365*30)=0.24 BTC. While most lending platforms require traders to deposit at least 1 BTC, traders can make a deposit starting from 0.05 BTC on Bexplus.

Independence: the wallet is independent of the trading account, so the deposits would not be used as margin, nor would it be influenced if your positions got liquidated. Furthermore, the deposits in your wallet will not be used by Bexplus for other purposes, so your deposits will not be “locked up.”

High Security: The platform uses multiple signature access, and all funds transferred from cold storage to hot wallets are manually processed and require multiple staff to coordinate.

No Penalties for Early Withdrawal: withdrawal requests will be processed within 1 day with no penalties for early withdrawal. If you withdraw your deposit on the tenth day of the month, you can still receive the interests generated within this period.

No KYC Requirements: all registrations on Bexplus are done via email verification. You don’t have to worry about getting your information leaked. You can start trading within a few minutes and the transaction between the trading account and wallet is instant.